Electric cars to remain in slow lane in India

- Weak consumer appetite, lack of charging infrastructure and a high payback period is holding back adoption of electric cars for personal use in India.

Ameya Joshi, a Mumbai-based businessman, bought a Tata Nexon EV in May 2020. After eight months, Joshi says the experience has been “very satisfying and exhilarating.”

Be it the range, charging time, safety or overall driving performance, the Nexon EV ticks all the boxes. “I haven’t been near a fuel pump for two months,” says Joshi, 35, who owns two other cars powered by petrol and diesel.

The stamp of approval by buyers like Joshi comes two decades after Chetan Maini, founder of Reva Electric Car Co (RECC), gave India its first electric car. The tiny all-electric two-seater hit the market in 2001 when the concept of an electric car was much ahead of its time. Reva failed to gain traction, mainly because it cost twice as much as a four-seater compact.

Twenty years since then, the electric vehicle (EV) evolution in India’s passenger vehicle market has remained frozen in time and may see limited adoption over the next decade, experts say. Weak consumer appetite, inadequate charging infrastructure, an inconsistent policy roadmap and a high payback period, among other factors, has stymied EV adoption in the personal car segment.

To a great extent, carmakers are still grappling with the same issues which dogged Reva — high cost of acquisition, battery costs, range anxiety, infrastructure-related issues and high payback period.

Road ahead

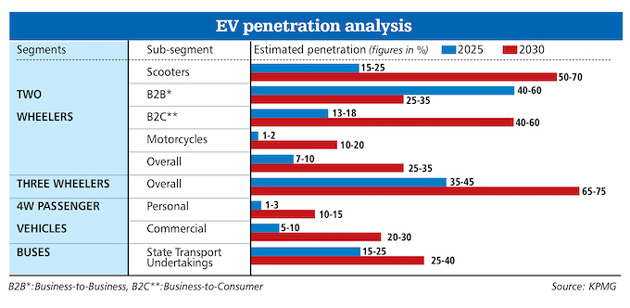

Electrification in the personal vehicle segment is likely to lag compared with other segments, according to KPMG India. Based on an analysis of key enablers, the consulting firm expects 10-20% penetration of personal electric cars and 20-30% in the commercial segment by 2030. It forecasts the percentage to be much higher for two- and three-wheelers — 25% to 35%, and 65% to 75%, respectively.

Experts at other consulting firms agree. “At the sticker prices which are affordable, availability will continue to be challenging. We continue to see electric car as a second or third car for people who can afford it,” says Rahul Mishra, partner at Kearney, a consultancy.

That, however, hasn’t deterred Tesla Motor, a brand that has become synonymous with e-cars globally, from coming to India. Earlier this month, the Elon Musk-founded company announced setting up a wholly owned India subsidiary and is all set to launch its flagship Model S in the Indian market.

Given its expensive ticket prices (starting from INR 5.5 million or USD 75,115), Tesla models will be affordable to only a handful, but it will add a shine to the e-cars and make them a lot more aspirational.

To be sure, adoption has been slow even as India has a compelling case in the form of high dependence on imported fossil fuel and a deteriorating air quality in cities. The transport sector’s contribution to greenhouse gas emission stands at 23%, according to KPMG.

The country reported 23 million deaths in 2017 due to air pollution, and serious health consequences from air pollution has cost 5.4% of India’s GDP.

Policy push

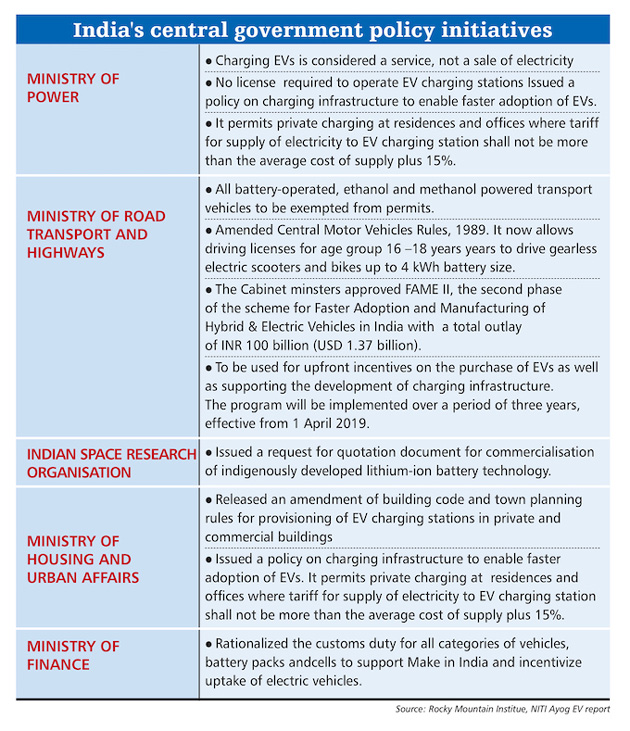

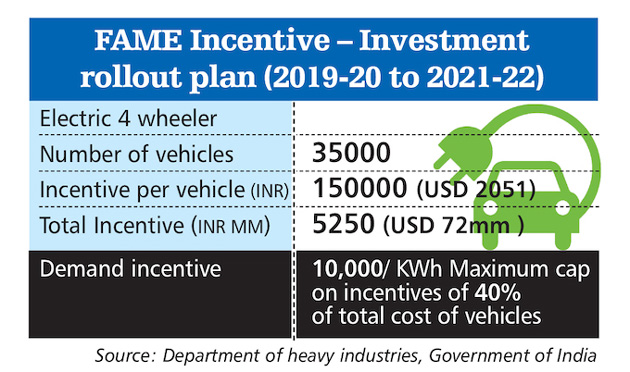

Federal and state governments have rolled out various initiatives over the past six years to boost electric mobility. For instance, the federal government’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) is aimed at making EVs more affordable and reduce the price gap with vehicles running on internal combustion engines (ICE).

The scheme addresses all segments of the automobile market, including charging infrastructure, but leaves cars or SUVs bought for personal use out of its ambit.

The state governments’ incentives address the supply side of the value chain to encourage investments, but this may not be enough, says Shifting Gears: the evolving EV landscape in India, a report by KPMG. States need to focus on offering demand incentives to reduce the gap with ICE vehicles, it says.

Besides the policy push, EVs perhaps need other benefits such as reduced taxes. Most states, with the exception of Delhi, have been silent on this aspect, says the report.

It also suggests regulations and schemes for the auto sector including that scrappage incentive scheme or fuel efficiency norms should be linked to EVs for a concerted push. It also recommends that states have a target for EV conversion, citing the instance of Delhi for a segment level or for a use case.

The various incentives are yet to translate into competitively priced, aspirational EV models for personal use. The success stories have been few and buyers like Joshi remain a handful.

Till date, there are only three manufacturers that sell models that have a range of over 300 km. The most affordable and the highest selling EV currently is the Tata Nexon EV, based on the ICE-powered sub-4m SUV, which claims 312 km on a full charge, with prices ranging between INR 1.4 million (USD 19,000) and INR 1.6 million.

The Hyundai Kona Electric retails from INR 2.4 million (USD 32,800) onwards and its closest rival, the MG ZS EV, starts from INR 2.1 million (USD 28,700). The Nexon EV remains the only model which has managed to interest a significant number of buyers.

Market leader stays away

Popular ICE brands such as Maruti Suzuki that controls more than half of India’s passenger vehicle market has so far stayed out of the EV segment. The local arm of the Japanese carmaker has no plan to get into it in the near future, says R.C. Bhargava, chairman, Maruti Suzuki India.

“Why do you think something that hasn’t happened last year, will happen this year? Nothing has changed. Nobody is making batteries in India or investing in a battery making plant,” says Bhargava.

The strategic aspect of an EV remains weak. “Can one go whole hog on electrification based on imported lithium?” Bhargava questions.

The main reason why one hasn’t seen electrification in the EV space take off is because of cost and infrastructure, he points out. “A year and half ago, people claimed the cost of the lithium batteries will come down drastically. Has it happened?”

Local arms of other Japanese carmakers in India have also not been in favour of a pure battery operated electric vehicle, and are of the view that hybrids instead of EVs is a more viable alternative for a market like India.

The plans of India subsidiaries of global manufacturers will be guided by the stance the parents have taken on clean mobility. “It will be a trickledown effect in India,” says Kearney’s Mishra.

“Some manufacturers in India may have launched EVs, but this is only to keep policymakers happy,” said a top official at a Japanese carmaker, who declined to be named. “Where are you going to get the raw material from? Won’t you rather opt for a smaller battery pack and go for hybrids? Instead of importing oil, we will import lithium batteries and other raw materials. It’s not a commercially viable proposition, but a loss making one till the volume picks up.”

No one can vouch for this better than Maini, who struggled with the Reva before ceding majority control to Mahindra and Mahindra in 2010, and subsequently quitting the company in 2015.

“In the personal mobility space in cars, there is a very small percentage of people who like EVs and are willing to pay a premium. It makes it more difficult that the options are very less. It’s a bit of a chicken and egg situation,” says Maini.

OEMs (original equipment manufacturers) are not investing as they are concerned about infrastructure. India has installed just 933 charging stations by June 2020, according to data from Central Electricity Authority. This is a drop in the ocean for a large country like India.

Range anxiety

It will take a while before the government sets up the charging infrastructure across cities, says Maini. While in the shared mobility space, swapping stations are addressing the problem it’s not happening in the passenger car segment. The range anxiety is still a concern, he adds.

Even in its new avatar and after getting a new name, E2O, Reva struggled, forcing its new owner Mahindra to pull the plug on the model in 2019. Having struggled in the personal mobility space, it de-prioritised the segment and is now focused in launching EVs in the last mile delivery segment and shared mobility space.

“EVs in the shared transportation space will take a back seat amid the pandemic,” Pawan Goenka, managing director and chief executive at Mahindra and Mahindra said at a media briefing. M&M plans to launch the e-KUV100 for the fleet segment in the last quarter of the current fiscal.

Despite a long road ahead, Shailesh Chandra, president, passenger vehicle business unit at Tata Motors, is a lot more optimistic on personal electric cars. His optimism stems from the initial sales response. Tata Motors has sold close to 1,765 units of the model in the first half of 2020 despite the Covid-19 pandemic that crushed consumer demand, and has been clocking a monthly average of 400 cars.

According to Chandra, EVs have come into the consideration set of mainstream consumers who want to purchase a car. EV customers earlier were a sophisticated lot who demanded and had a different sort of requirements, those who like new technology or wish to be seen leaving a lower carbon footprint.

“While the fleet segment has crashed, the personal one will grow every month. The other two EV models (other than us) are highly priced compared to 100 models available for the IC (internal combustion) segment,” says Chandra.

First mover advantage

Given the criticality of scale in the automobile business, the volumes are nothing to write home about. But it has helped the firm get much needed acceptability and gain a first mover advantage.

Kearney’s Mishra says any demand that the market has seen in the recent past is a combination of deferred and festival demand. Therefore, one needs to wait for the impact of these factors to level out to understand how much of this is pent up and how much of this is intrinsic.

Goenka of M&M believes the government has done its bit and “it’s now up to the manufacturers to drive e-mobility.”

M&M, one of the first to get into the electric vehicles, strongly believes that shared mobility in passenger cars and commercial vehicles is the way forward and the company’s plans are in line with this thought. It plans to introduce the e-KUV1OO for the shared mobility space by March 2021.

Even as Japanese carmakers in India remain sceptical of EVs, Korean carmakers Hyundai and Kia Motors, in line with their global strategy, are likely to go full throttle with their EV plans.

Kia Motors plans to launch seven electric cars globally by 2027. The first of these that is being developed ground up is expected to break cover in 2021. Its sister brand Hyundai too is encouraged by the response to the Kona SUV it launched in India in 2019.

“As a caring and responsible brand, our strategy is to showcase our commitment towards environmental integrity and align our plans with Government of India’s mission of creating a sustainable ecosystem for electric mobility,” says a Hyundai India spokesperson.

The company has got “an electrifying response” to India’s first long range green SUV, called KONA Electric, with more than 600 bookings till date, the spokesperson says. “This affirms Indian customers’ acceptability towards high-end future technologies.”

Also in the works is a mass-market electric vehicle for India with a suitable body type and higher localisation level but it will depend on the demands of Indian customers, the spokesperson added.

Meanwhile, European carmakers like Renault and Volkswagen have been closely watching the EV market evolve in India. But even as they showcased the EV offerings in their stable globally at New Delhi Auto show in 2020, none has firmed up any plan of launching them yet. The unprecedented crisis triggered by the pandemic has forced them de-prioritise EVs and first get the core business back on track.

Tryst with e-mobility

India’s tryst with e-mobility in the car segment took a turn in 2017, when Energy Efficiency Services (EESL) — a joint venture between public sector units under ministry of power — floated a tender for procuring electric cars.

Homegrown manufacturers Tata Motors and Mahindra and Mahindra emerged as the lowest and second lowest bidders and got orders to supply 10,000 cars. But EESL could not execute the order due to lack of demand, charging stations and range-related issues.

In September 2020, EESL announced procurement of 250 long-range electric vehicles from Hyundai Motor India and Tata Motors, to be used by government officials.

EVs with subsidy are expected to reach parity with diesel cars in terms of total cost of ownership (TCO) around 2022. In case no subsidy is offered, the parity may be delayed till 2025.

Parity with petrol cars is expected by 2025 but that could be pushed back to 2030 without subsidy, KPMGs estimates.

How green are EVs?

Even as all the stakeholders, policymakers, manufacturers, environmentalists and civil society broadly agree that EVs are the most viable solution for one of the world’s most polluted countries, debates around the green credentials of EVs have often come to the fore.

Experts argue that the carbon footprint has to be seen in three buckets – fuel and how it’s produced, carbon footprint of manufacturing the EVs and tailpipe emissions. Given that the majority of India’s power plants are coal-fired, the country loses out on that count.

“We will say it’s still easier to control pollution at the power plant level than trying to control the tailpipe emission from billions of vehicles,” says Anumita Roy Chowdhury, executive director, research and advocacy, at think tank Centre for Science and Environment.

Moreover, India has a big renewable energy portfolio. Gadgets run on electricity. “Electricity is the fuel of the future, and we should have a policy on cleaner electricity generation,” says Roy Chowdhury.

Shally Seth Mohile is a senior journalist based in Mumbai.

This article first appeared on India Climate Dialogue.